Asymmetric Information and Limit Pricing

In 1982, Milgrom and Roberts published their Limit Pricing Model in Econometrica, on which they put forward the idea that limit pricing involves charging prices below the monopoly price to make new entry appear unattractive. Pay attention that limit pricing only finds formal justification under incomplete information, based on the paper of J. Friedman.

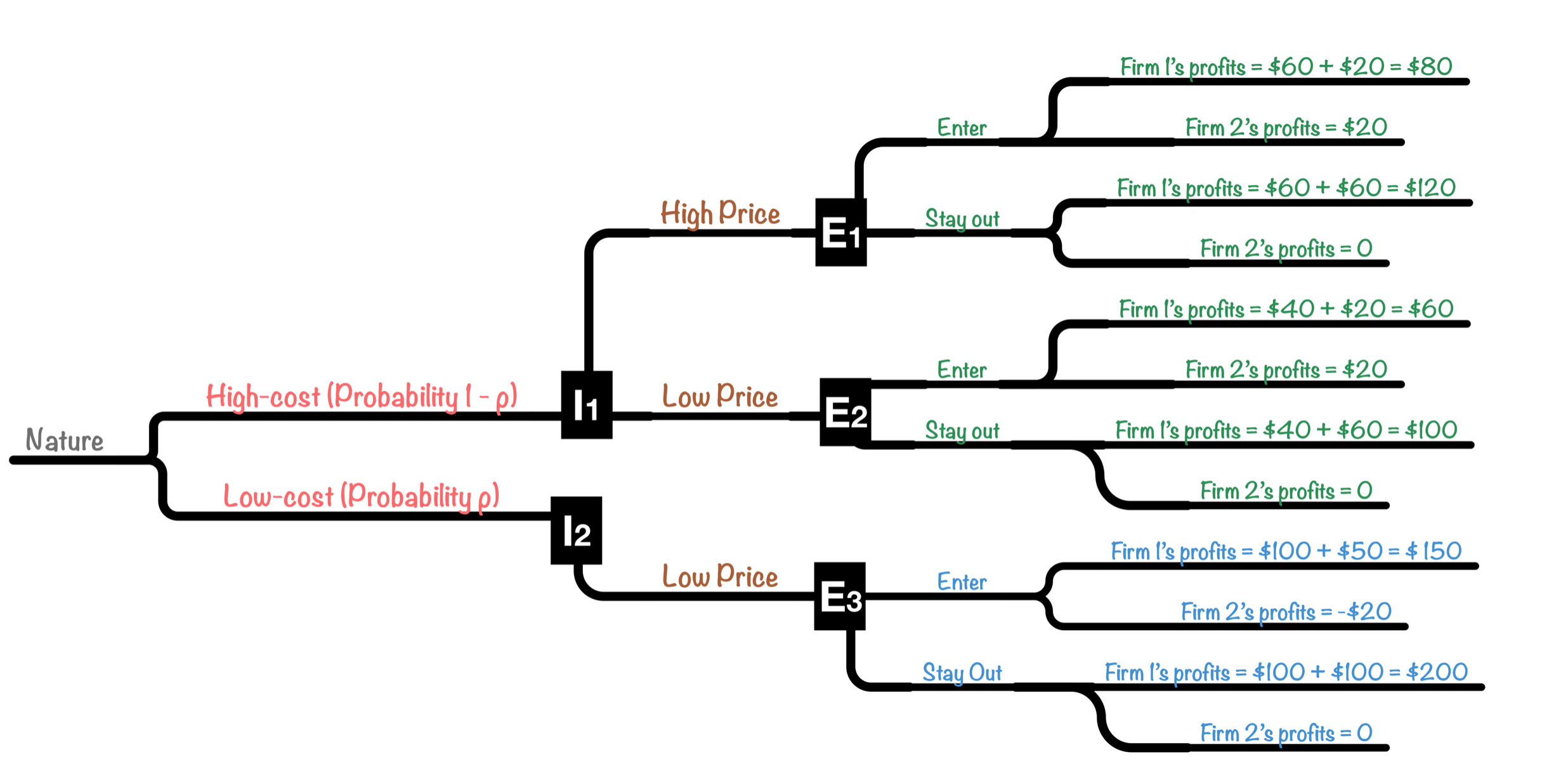

In our setting, we have a two period game. In period 1, established firm 1 acts as a monopolist, and in period 2, potential entrant firm 2 decides whether to enter. Our assumption is that firm 1’s unit cost could be either high or low, but firm 2 does not know firm 1’s cost of production.

In the first period, the player Nature moves first and chooses the cost of firm 1. Then firm 1 moves next and sets a either a high or low price.

If Nature chooses firm 1 to be a low-cost monopoly (with a probability ρ), it will gain a profit of $100 if firm 1 sets low price; it is not possible for firm 1 to set high price. However, if Nature chooses firm 1 to be a high-cost monopoly (with a probability 1 - ρ), it will gain a profit of $60; if firm 1 sets high price, or a profit of $40 if firm 1 sets low price.

In the second period, firm 2 decides whether to enter or to stay out.

If firm 2 decides to stay out, its profits will be $100 if firm 1 is a low-cost monopoly; while $ 60 if firm 1 is a high-cost monopoly. By the time, firm 2’s profit is 0 because it stays out of the market.

However, if firm 2 decides to enter, its profits will be $50 if firm 1 is a low-cost monopoly; while $ 20 if firm 1 is a high-cost monopoly. If firm 1 is a low-cost monopoly, firm 2’s profits is -$20; if firm 1 is a high-cost monopoly, firm 2’s profits is $20. We can see the two period game in the chart below:

(Extensive form of the Sequnential Entry game with asymmetric information on cost [Using my favorite OmniGraffle])

The asymmetry of information can be captured by circling together nodes E2 and E3. When firm 2 observes a low price in the first period, it does not know whether that correponds to E2 or E3, but firm 1 knows.

Note that firm 2 will not simply believe that “low price means low cost, high price means high cost”. It will adopt an alternative way. When firm 2 observes a low price it simply concludes that firm 1 is a low-cost firm with probability ρ and a high-cost one with probability (1 - ρ).

From firm 2’s perspective, second period entry will yield an expected profit of [(1 - ρ)$20 - ρ$20] = 20 - ρ$40. If ρ > 1/2, then firm 2’s expected profit from entering is negative. Consequently, it will not enter if it observes a low price.

From firm 1’s perspective, if the probability of being a low-cost firm ρ > 1/2, it will do better by pretending to be a low-cost firm and setting a low price in the first period even if, in reality, it is a high-cost firm. That is, when ρ > 1/2, a high-cost firm 1 will set a limit price — one lower than its true profit-maximizing price.